Climate Change Risk Assessment Matrix

The generation foundation (http://genfound.org/library/ ) has published a paper on stranded assets and the risks of climate change to companies and investments. It identifies three primary risk categories for investments, regulation, market forces and socio-political pressures. They are summarized as follows in the allocating capital for long term returns paper.

Risk 1 – Regulation: Pending and future changes in laws and regulations that would affect carbon-intensive business models can take at least four forms: (a) Direct regulation that is globally coordinated or led by local, provincial, national, regional supra-national, or global authorities; (b) Indirect regulation affecting carbon-intensive assets through restrictions on pollution or water use, and measures aimed at addressing health impacts;(c) Mandates on renewable energy adoption as well as efficiency standards; (d) Impending regulations that create uncertainty for long-lived carbon-intensive assets.

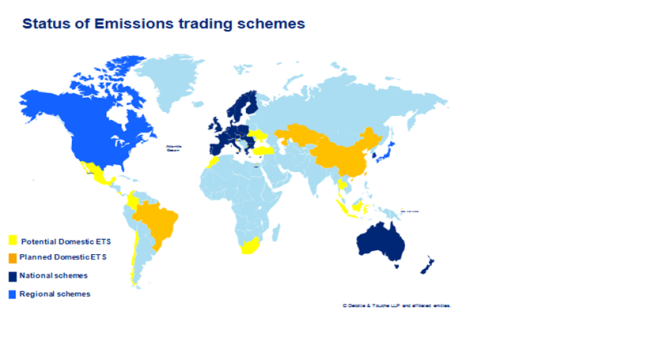

- Direct Regulation: Regardless of whether carbon pricing manifests as a coordinated global response to the Carbon Budget or is enforced through national, regional, state or local carbon pricing or ‘cap and trade schemes’, the result would be a material shift in the valuation of carbon-intensive assets over a short period of time and hence the stranding of carbon assets.

- Indirect regulation: Increased pollution control, water-use restrictions, or policies targeting health related concerns, indirect regulation could negatively impact carbon-intensive business models.

- Renewable Energy and Efficiency Mandates: Mandates on renewable energy adoption as well as the implementation of efficiency standards can lead to the accelerated development and adoption of alternatives to carbon-intensive assets.

- Impending Regulation: A significant overhang of other impending regulatory actions creates uncertainty for long-lived carbon-intensive assets, and is likely to add to the pressures that will increasingly drive capital away from those assets.

Risk 2: Market Forces: Renewable technologies are becoming economically competitive with traditional energy sources in a number of countries, without the need for subsidies, because costs continue to decline. Cost competitiveness, combined with the ability to secure stable, long-term prices for power, and produce electricity through a distributed model, are driving increased allocation of capital away from fossil fuels and towards renewables.

Risk 3 : Socio-political pressures : In the absence of regulation, sociopolitical pressures could create an environment where carbon intensive businesses could lose their license to operate.

A guess the analysis is at least one place to start. However, generally I do not find these particularly useful, First of all the focus is on the risk of regulation and effectively five of the subcategories are related to the risk of regulation.

While there are many definitions of risk ( http://en.wikipedia.org/wiki/Risk ) oneof them is the probablility of an event happening times the impact of that event. Assessing a particular investment simply based on the risk as outlined in the paper of the generation foundation does not tell us much.

Including a probability and impact assessment will address my other need for ensuring that some other risks including the social values and license to operate receive more recognition. This would be of course for companies and investments that are more exposed to these risks including companies which require infrastructure and/or rights of way to transmit / ship fossil fuel based energy.

In addition, in this risk analysis, there is no recognition of the costs of climate change to the business operations. How will the supply chain be affected, will there be increased shipping costs and other input costs, is the company exposed to any of the climate weather events that are starting to occur, will there be any costs associated with adapting to climate change etc.

The document also states a number of actions that investors should take, One of these is that “at a minimum investors should determine the extent to which carbon risk is embedded in their current and future investments. This can be achieved by considering the key drivers of a company’s asset base and revenue; reviewing the focus of its short- and long-term capital expenditure strategy; asking management how carbon risk might impact the company’s business model; and asking what steps have been taken – for example do they incorporate an unreported ‘shadow price’ on carbon when developing the business’ strategy?” (Generation Foundation. 2014. Stranded Carbon Assets – need to confirm the title). Using the risks identified in this paper, the risk analysis could look something like:

|

Stock |

Bond |

Project |

| Risk 1 – Regulation |

| Direct Regulation |

|

|

|

| Indirect Regulation |

|

|

|

| Mandates on Renewable energy adoption and efficiency |

|

|

|

| Impeding regulation that creates uncertainty |

|

|

|

| Risk 2: Market Forces |

| Renewable energy price competitive |

|

|

|

| Risk 3 : Socio-political pressures |

| License to operate at risk |

|

|

|

Including the probability and the impact:

In any one given scenario of the future when looking at the probability of that scenario as applied to one or more investments, the probability that regulation will take place should be the same. However the impact of that action will be different on the each option / investment / company. Based on this analysis, the risk is effectively a proxy for the impact on a sector.

Only when assessing different political, economic and other scenarios would the probability vary. For example, the probability of regulation would vary depending on which party was elected in that country or the probability of a regulation would vary based on the which direction public opinion sits. In these cases, when looking at one investment in the two scenarios, while the probability would be different, the impacts of the regulation would be the same – again assuming only looking at the same investment across the two scenarios.

However, for sensitivity and resilience analysis comparing a set of investments across scenarios and applying a particular probability to a scenario may shed light on a better mix of set of investments based on analysis of a significant set of companies. Then investments could be made which are shown to be more resilient or have less risk than others in a world with potential for carbon regulation. This would be similar to portfolio analysis done around other factors that can change and impact investments (e.g. interest rates, economic growth, sales targets etc.).

In addition much of the assessment will depend on the specific nature of the regulation. For example will the carbon pricing regulation directly increase the price for producers or will it be applied at the consumption side. Will it also be applied to fuel that is being exported or is that considered to be tariff-free? These details are not discussed and explored here.

In addition, in some cases these actions could have a negative or a positive impact. This depends of course on the sector and the details of the regulation.

For example, if we used this risk assessment to assess a number of companies on a hypothetical level and very high level, here is what some of the results could be:

|

EV vehicle manufacturer/sales and distribution |

Fossil fuel Pipeline company |

| Risk 1 – Regulation |

| Direct Regulation |

Small negative impact:

Direct regulation would not directly affect the operations of the EV company but in locations where fossil fuels are burned to generate electricity, this could mean that the EV will cost more to fill up. |

Medium negative Impact:

Since the pipeline company would be transporting fossil fuels, the demand for the fossil fuel could decrease based on the regulation. This would not likely be a short term impact. |

| Indirect Regulation |

Zero impact |

Small negative impact:

Unlikely to have a greater impact that direct regulation |

| Mandates on Renewable energy adoption and efficiency |

Moderate positive impact: Depending on if the mandates including incentives for EV support. Otherwise, small positive impact. |

Small negative impact: Increased efficiency and renewable energy could affect demand and be a medium term impact. |

| Impeding regulation that creates uncertainty |

Small positive impact:

The threat of impending regulation could strengthen the business model of the EV company. |

Small negative impact –

This would differ based on the fuel actually transported by the pipeline company |

| Risk 2: Market Forces |

| Renewable energy price competitive |

Small positive impact: Renewable energy could decrease the price of electricity making the case of EV vehicles stronger |

Small negative impact: Where renewable energy directly competes with the fossil fuel energy in question. there could be a small decrease in demand. However, different than electricity, there are no easy and scaled and readily available renewable alternatives to many fossil fuels in large amounts. Biofuels and biomass are available but are also only available in small quantities. |

| Risk 3 : Socio-political pressures |

| License to operate at risk |

Zero impact: |

Small negative impact: While existing pipelines would continue to operate with little issue unless there was a spill, it would be difficult to get new pipelines and infrastructure |